Banks and financial firms get £1.2 billion discount on fines

-

CreatedMonday, 03 April 2017

-

Created byNesrin Ercan

-

Last modifiedWednesday, 03 May 2017

-

Revised byNesrin Ercan

-

Favourites1228 Banks and financial firms get £1.2 billion discount on fines /icc_2527/index.php/site_content/item/1228-banks-and-financial-firms-get-1-2-billion-discount-on-fines

-

Categories

Banks and financial firms have received discounts of £1.2 billion on fines imposed by the UK Financial Conduct Authority (FCA) in the last four years, recently released data by the think-tank New City Agenda has revealed.

Banks and financial firms have received discounts of £1.2 billion on fines imposed by the UK Financial Conduct Authority (FCA) in the last four years, recently released data by the think-tank New City Agenda has revealed.

Banks and financial firms have received discounts of £1.2 billion on fines imposed by the UK Financial Conduct Authority (FCA) in the last four years, recently released data by the think-tank New City Agenda has revealed.

Banks and financial firms have received discounts of £1.2 billion on fines imposed by the UK Financial Conduct Authority (FCA) in the last four years, recently released data by the think-tank New City Agenda has revealed.

New City Agenda said between 2013 and 2017, the FCA levied 82 financial penalties on banks and other financial firms, fining them a total of £3 billion, but almost half of that amount was reduced.

Of the 82 financial penalties levied, on 66 occasions firms received a discount of 30%, on eight occasions they received a discount of 20% while in a further eight cases, firms received no discount.

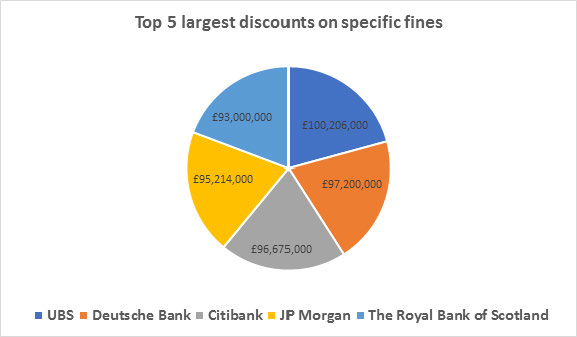

New City Agenda’s data shows that Deutsche Bank received the largest total discount on its FCA fines at £165 million, followed by RBS at £157 million and JP Morgan at £155 million. The top five discounts applied to individual fines, all pertaining to penalties for foreign exchange manipulation.

Banks and other financial firms which are subject to enforcement action by the FCA can receive discounts of up to 30% on their fines if they settle their case.

The Criminal Finances Bill was introduced to the UK House of Commons in October 2016. It aims to significantly improve the government’s ability to:

• tackle money laundering and corruption,

• recover the proceeds of crime, and

• counter terrorist financing

The Bill is a key element of one of the most significant changes to the UK’s anti-money laundering and terrorist finance regime in over a decade. It is part of a wider package of measures aimed at strengthening the government’s response to money laundering and improving the amount of criminal assets confiscated by the state (and, where possible, returned to victims).

Lord Sharkey, a member of the UK House of Lords, is proposing an amendment to the UK Criminal Finances Bill, requiring banks and other financial firms to identify and take disciplinary action against staff responsible for the misconduct before they receive the full discount on a FCA fine.

During a recent parliamentary debate, Lord Sharkey, who is a director at New City Agenda, said, “My amendment proposes to put the gigantic discount mechanism to better use. It would enable the FCA to have direct sight of the improvements in process and behaviour agreed in any settlement.

“It would enable it to see that appropriate disciplinary action had been taken against those responsible for the transgressions. It would give the settling firms a powerful incentive to fulfil any settlement conditions.”

He added, “This is a simple proposal. It would give the FCA more power, more say and more insight into how transgressors had modified their behaviour and addressed individual and structural culpability. It would give the firms involved a powerful incentive to take proper remedial action—which, unfortunately, still seems to be needed.”