Scams and data breaches drive up UK financial fraud losses

-

CreatedMonday, 21 March 2016

-

Created byNesrin Ercan

-

Last modifiedTuesday, 22 March 2016

-

Revised byNesrin Ercan

-

Favourites1168 Scams and data breaches drive up UK financial fraud losses /icc_2527/index.php/site_content/item/1168-scams-and-data-breaches-drive-up-uk-financial-fraud-losses

-

Categories

Financial fraud losses in the UK reached £755m in 2015, a 26 percent rise on 2014, Financial Fraud Action UK (FFA UK) has revealed.

Financial fraud losses in the UK reached £755m in 2015, a 26 percent rise on 2014, Financial Fraud Action UK (FFA UK) has revealed.

Scams and data breaches drive up UK financial fraud losses

Scams and data breaches drive up UK financial fraud losses

Financial fraud losses in the UK reached £755m in 2015, a 26 percent rise on 2014, Financial Fraud Action UK (FFA UK) has revealed.

According to FFA UK, the main drivers behind the increase include the threat posed by impersonation and deception scams, alongside the growth in sophisticated online attacks such as data breaches and malware.

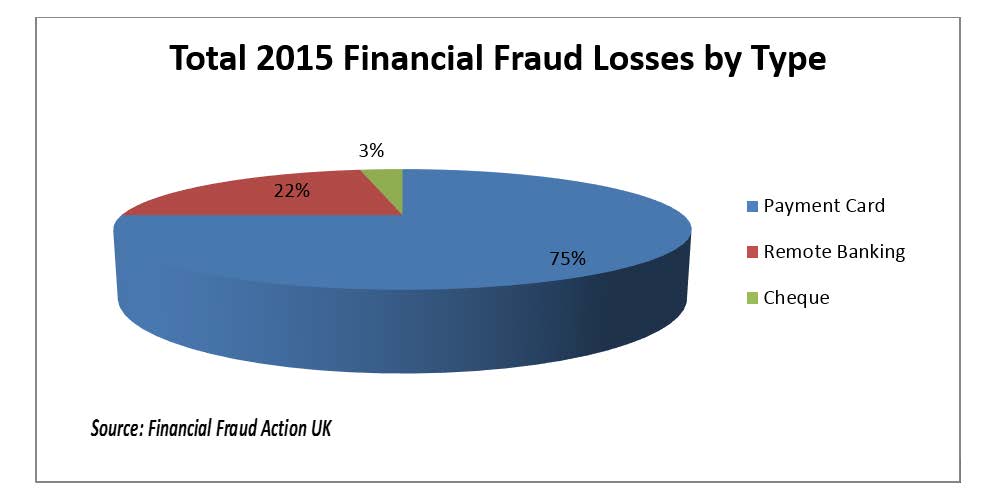

The report showed that fraud losses on UK payment cards came up to £567.5m last year, an 18 percent increase from £479m the previous year.

Remote banking fraud losses soared 72 percent, hitting £168.6m, compared to £98.2m in 2014.

However, cheque fraud losses fell by six percent, totalling £18.9m in 2015. In 2014 it was £20.2m. This is the lowest ever annual total seen since 2011.

The organisation said one of the key drivers of the changing fraud figures in 2015 was the use of impersonation and deception scams by criminals.

The perpetrators would approach customers claiming to be from a trusted organisation, such as a bank, with the aim of obtaining personal and financial details that will then be used to commit fraud.

These scams often involve a phone call, text message or email claiming there has been suspicious activity on a customer’s account or that their account details need to be ‘updated’ or ‘verified’.

Criminals also attempt to trick people into transferring money directly to them, FFA UK said.

Another common fraud was criminals’ use of information gained through data breaches. FFA UK noted there had been several high profile breaches reported in 2015, as well as many other smaller-scale attacks.

“The stolen data is used to commit fraud directly, for example using stolen payment card details online to commit remote purchase fraud,” it said.

“Other information obtained through a breach may be used in impersonation scams, while the publicity around the incident itself can be used to add authenticity to the scammers’ approach.”

The use of malware and phishing emails to compromise customers’ security and personal details was also another popular scheme.

These modus operandi are not unfamiliar, and ICC’s Commercial Crime Services – which provides banks and financial services a range of Know Your Customer and financial fraud services – has also come across similar cases.

With fraudsters using stolen information gained through data breaches to commit fraud and aid deception scams, FFA UK is urging businesses and organisations that hold personal and financial data to improve their security systems in order to prevent data breaches.

It is also reminding retailers selling remotely that there are a number of tools they can use to build up a profile of their customer, verify the cardholder and ensure they receive payment securely.

Katy Worobec, Director of FFA UK, said: “Banks work extremely hard to protect their customers, using highly sophisticated security systems which stopped 70 percent of attempted fraud from occurring last year.

“Any increase in fraud is unwelcome but the industry is continually evolving its response to fraud as it develops. This includes investing in new detection and verification tools, working with law enforcement and educating customers of dangers.”

More information about the work of CCS, can be found here.